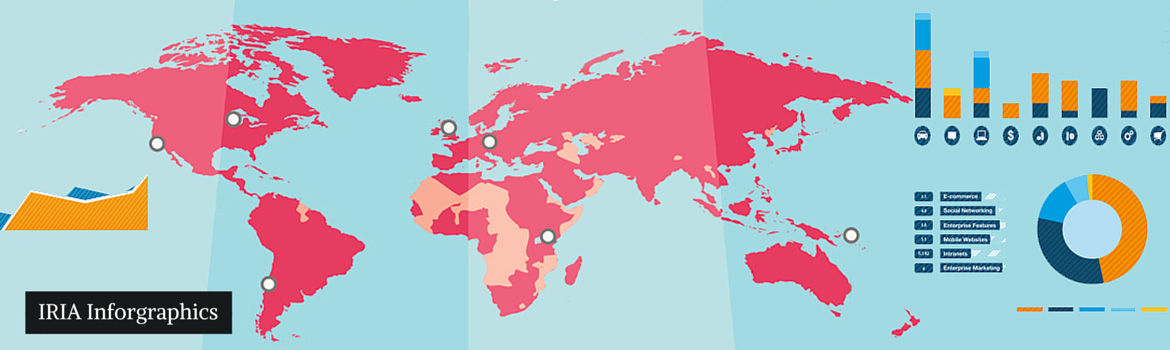

Global Arms Trade 2020–2024

March 14, 2025

US leads Global Arms Exports as Ukraine Becomes World's Biggest Arms Importer

The global arms trade saw a complex shift between 2020 and 2024 amid evolving security concerns and geopolitical tensions, particularly the ongoing war between Russia and Ukraine. For many countries, the conflict marked a turning point, driving significant increases in both arms exports and imports. For some in Europe, the need to secure military support in the face of war has never been more urgent.

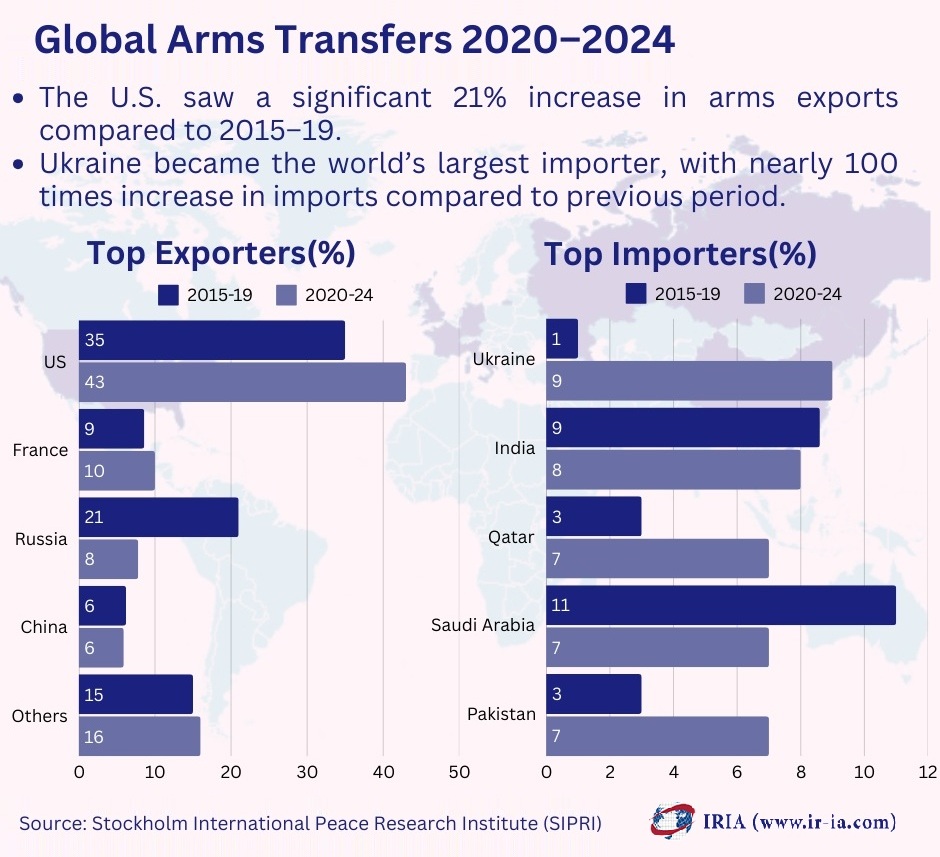

According to the latest report by the Stockholm International Peace Research Institute (SIPRI), the volume of international arms transfers was slightly down by 0.6% compared to the previous period of 2015-19 since the increase in arms transfers to Europe and the Americas was offset by a decrease in transfers to other regions.

The United States, France, Russia, China, and Germany were the world’s five largest arms exporters during 2020–24. The U.S. saw a notable 21% rise in its arms exports, while France’s increased by 11%. In contrast, Russia experienced a dramatic 64% drop in its arms exports, a reflection of its changing role on the global stage.

On the import side, Ukraine, India, Qatar, Saudi Arabia, and Pakistan were the leading recipients of major arms. Of these, Ukraine’s arms imports skyrocketed nearly 100 times in 2020–24 compared with 2015–19—a staggering increase driven largely by international support amid its war with Russia.

The surge in European arms imports, which rose by 155% over the same period, highlights the profound impact of Russia’s actions and the shifting security dynamics within NATO and beyond. Meanwhile, the U.S. solidified its position as the dominant arms exporter, accounting for 43% of global exports. In 2020–24, countries in Asia and Oceania accounted for 33% of global arms imports, followed by Europe (28%), the Middle East (27%), the Americas (6.2%), and Africa (4.5%). The Americas (6.2%) and Africa (4.5%) made up smaller shares of the global arms import market.

The changing landscape of arms trade reveals much about the ongoing geopolitical struggles and the responses of key players on the global stage.

Key Highlights from SIPRI Report (March 2025):

• The top five arms exporters in 2020–24 were the U.S., France, Russia, China, and Germany.

• Leading arms importers during 2020–24 were Ukraine, India, Qatar, Saudi Arabia, and Pakistan.

• Ukraine was the world’s largest arms importer, receiving 8.8% of global arms due to the 2022 Russian invasion.

• U.S. arms exports increased by 21%, while Russia’s dropped by 64%. France's exports rose by 11%.

• The U.S. supplied 64% of arms imports to European NATO states, up from 52% in 2015–19.

• African arms imports fell by 44%, mainly due to declines in Algeria and Morocco, though sub-Saharan Africa saw a 4.2% increase.

• Brazil’s arms imports surged by 77%, making up 49% of South American imports, with France as the largest supplier (30%).

• Combat aircraft remain the primary long-range strike weapon, but demand for long-range land-attack missiles is rising. The U.S. supplied 45% of global missile exports.

Top Exporters of Weapons

U.S. remains world’s biggest arms exporter – The United States has solidified its position as the world’s largest arms exporter, accounting for 43% of global weapons exports between 2020 and 2024—more than four times the share of France. A key factor behind this growth is Europe’s increasing reliance on U.S.-made weapons, which more than tripled (+233%) between 2015–19 and 2020–24. American arms accounted for nearly two-thirds of NATO members’ imports in the past five years, up from just over half between 2015 and 2019.

Troops firing the Javelin anti-tank guided missile on the ground. (Image Credit: Raytheon/RTX)

Troops firing the Javelin anti-tank guided missile on the ground. (Image Credit: Raytheon/RTX)

“The USA is in a unique position when it comes to arms exports … It continues to be the supplier of choice for advanced long-range strike capabilities like combat aircraft,” said Mathew George, Program Director at SIPRI Arms Transfers Program.

For the first time in two decades, the majority of U.S. arms exports went to Europe rather than the Middle East. This shift comes as European countries, particularly in response to Russia’s 2022 invasion of Ukraine, have sought more American-made weapons.

Ukraine, in particular, has become a major importer of U.S. arms, receiving vast quantities of weapons and military equipment to support its defense. Additionally, U.S. exports have included a high proportion of second-hand arms, with 71% of U.S. exports to Ukraine sourced from existing stocks for rapid delivery.

Beyond Europe, the U.S. has also maintained a strong presence in other regions. In the Middle East, 33% of U.S. arms exports were delivered to states such as Saudi Arabia, Qatar, and Kuwait. Meanwhile, in Asia and Oceania, the U.S. supplied 28% of its arms exports, largely motivated by concerns over the growing threat from China.

France surpasses Russia to become second largest arms exporter – France was the second-largest arms exporter in 2020–24, accounting for 9.6% of global arms exports, up from 8.6% in the previous period. French arms exports increased by 11% compared to 2015–19 and by 72% from 2010–14. During this period, France delivered major arms to 65 countries, with the largest shares going to Asia and Oceania (35%), followed by the Middle East (28%) and Europe (15%).

French Air Force Rafale B and C variant fighter jets. (Image Credit: Dassault Aviation)

French Air Force Rafale B and C variant fighter jets. (Image Credit: Dassault Aviation)

India was the top recipient, receiving 28% of France’s arms exports, nearly double the share sent to European states (15%). Qatar was the second-largest recipient, with 9.7%. France’s arms exports to Europe almost tripled (+187%) from 2015–19 to 2020–24, driven by deliveries of combat aircraft to Greece and Croatia, and various arms to Ukraine after Russia’s 2022 invasion. With a strong pipeline of pending orders, particularly in combat aircraft and warships, France is poised to maintain or expand its export position.

Russia’s arms exports fell by 64% – Russia’s arms exports fell sharply by 64% between 2015–19 and 2020–24, with its global market share dropping to 7.8%. This decline reflects both a shift in production priorities and the impact of multilateral sanctions.

Russia’s arms exports, which were already on the decline before its 2022 invasion of Ukraine, were much smaller in 2020 and 2021 compared to previous years. By 2024, exports remained 47% lower than in 2022, largely due to Russia prioritizing military production for its own forces and increased pressure from the U.S. and allies to halt Russian arms sales.

“The war against Ukraine has further accelerated the drop in Russia’s arms exports because more weapons are needed on the battlefield, trade sanctions make it harder for Russia to produce and sell its weapons, and the USA and its allies pressure states not to buy Russian arms,” according to Pieter Wezeman, Senior Researcher at SIPRI Arms Transfers Program.

During 2020–24, Russia delivered arms to 33 countries, with 74% of exports going to Asia and Oceania. India was the largest recipient, accounting for 38% of Russian arms, followed by China (17%) and Kazakhstan (11%). Exports to Africa and Europe were smaller, with 12% going to Africa and 7% to Europe, mainly to Armenia, Belarus, and Serbia. Despite a drop in orders from China and India, Russia’s most notable pending deliveries are to India, Iran, and Saudi Arabia. However, Russia’s pending export orders are low compared to those of the U.S., France, and South Korea.

Russian servicemen operating jammer drones at a test site. (Image Credit: Ministry of Defence of the Russian Federation/Vadim Savitsky)

Russian servicemen operating jammer drones at a test site. (Image Credit: Ministry of Defence of the Russian Federation/Vadim Savitsky)

Top 10 Largest Exporters of Arms (2020–24)

1. United States

2. France

3. Russia

4. China

5. Germany

6. Italy

7. United Kingdom

8. Israel

9. Spain

10. South Korea

Other major arms exporters

Other prominent arms exporters include China and Germany.

• China held 5.9% of global arms exports in 2020–24. However, political considerations have limited its appeal to some major importers, with Pakistan being the dominant customer—accounting for 63% of Chinese arms exports.

• Germany accounted for 5.6% of global arms exports. Its arms exports primarily served states in the Middle East (37%), Europe (34%), and Asia and Oceania (21%). Ukraine, Egypt, and Israel were key recipients of German arms.

Additional exporters such as Italy, the United Kingdom, Israel, Spain, and South Korea maintained steady performance, with some experiencing modest increases and others seeing slight declines.

Top 10 Largest Importers of Arms (2020–24)

1. Ukraine

2. India

3. Qatar

4. Saudi Arabia

5. Pakistan

6. Japan

7. Australia

8. Egypt

9. United States

10. Kuwait

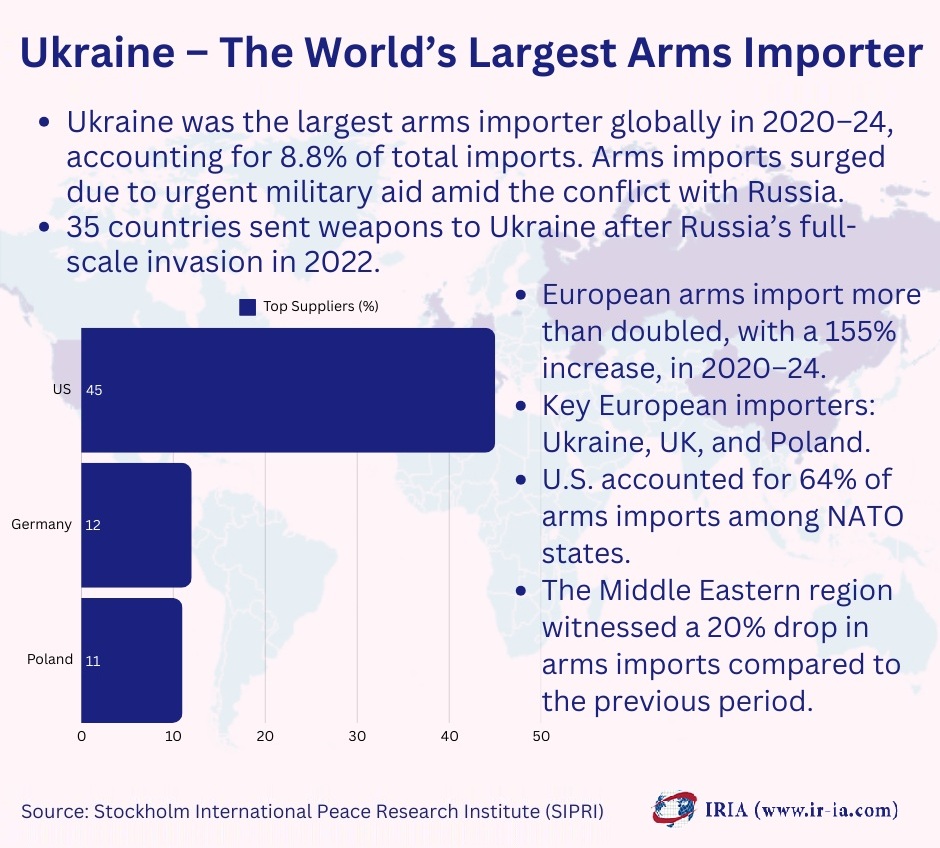

Ukraine tops global arms imports – Ukraine emerged as the world’s largest arms importer in 2020–24, accounting for 8.8% of global imports. The extraordinary rise in Ukrainian arms imports, an increase of almost 10,000% compared with 2015–19, was largely driven by urgent aid amid its conflict with Russia. Ukraine was the only European country among the top 10 global arms importers during this period.

Since Russia's invasion in February 2022, over 35 countries have supplied arms to Ukraine, primarily as aid. The U.S. was the largest contributor, providing 45% of Ukraine's arms, followed by Germany (12%) and Poland (11%). The influx of weapons significantly bolstered Ukraine’s long-range strike capabilities.

By 2024, Ukraine’s military received advanced systems, including long-range missiles and combat aircraft, further enhancing its ability to target Russian territory. France, the UK, and the U.S. delivered missiles with ranges up to 300 km, while Denmark, the Netherlands, and Norway provided combat aircraft, with more aircraft expected from Belgium and France.

Ukraine’s unprecedented arms imports in 2023 and 2024 solidified its position as the largest global importer of major arms for the 2020–24 period, a remarkable shift from its minimal imports before the war.

Other major arms importers

• India ranked as the second-largest importer, holding 8.3% of the global share. Although Indian arms imports fell by 9.3% between 2015–19 and 2020–24, this decrease is partly due to India’s growing domestic arms industry. Historically dependent on Russian arms (36% share), India is gradually diversifying its procurement, increasingly turning to Western suppliers such as France, Israel, and the United States.

• Qatar became the third-largest global importer with arms imports surged by 127% in 2020–24 compared to the previous period. The U.S. was its primary supplier, accounting for 48% of imports, followed by Italy (20%), the UK (15%), and France (14%). Qatar’s procurement included 42 combat aircraft from the U.S., 31 from the UK, 16 from France, and seven warships from Italy.

• Saudi Arabia, once the largest arms importer, saw a 41% decline in imports, dropping to the fourth-largest importer globally. The U.S. remained Saudi Arabia’s top supplier, providing 74% of its arms, followed by Spain (10%) and France (6.2%). This decline is partly due to the cyclical nature of arms procurement, but Saudi Arabia is expected to remain a significant arms importer based on pending deliveries.

Saudi Arabian armed forces members demonstrate capabilities at World Defense Show 2024. (Image Credit: Saudi Press Agency)

Saudi Arabian armed forces members demonstrate capabilities at World Defense Show 2024. (Image Credit: Saudi Press Agency)

• Pakistan’s arms imports rose by 61% between 2015–19 and 2020–24, driven by a large-scale procurement program that included combat aircraft and frigates. In 2020–24, Pakistan accounted for 4.6% of global arms imports, making it the fifth-largest importer. China remained the dominant supplier, providing 81% of Pakistan’s arms, up from 74% in the previous period.

Regional Trends in Arms Transfers

Africa

In Africa, arms imports experienced a sharp decline of 44% between 2015–19 and 2020–24. This drop was driven largely by reduced imports in key countries such as Algeria and Morocco. For instance, Algeria’s arms imports dropped after reaching a peak in 2015-19, while Morocco’s previously high growth rate reversed into a decline. Nonetheless, pending orders suggest that Morocco’s arms imports might see a future increase.

In terms of suppliers, Russia, China, and the U.S. were the main providers to African states, with Russia contributing 21% of African arms imports, followed by China (18%) and the U.S. (16%). Among sub-Saharan African states, although overall arms imports have remained low, accounting for 2.2% of global imports, countries in West Africa have seen significant increases due to deteriorating security conditions. Burkina Faso, Côte d'Ivoire, Mali, Mauritania, Niger, Senegal, and Nigeria saw big increases in arms imports. China, France, and Turkey are actively using arms exports to boost their influence in West Africa.

The Americas

Arms imports in the Americas increased modestly by 13% between 2015–19 and 2020–24. In this region, the U.S., Brazil, and Canada were the major importers. South American states experienced a 15% rise in arms imports, with Brazil alone accounting for nearly half (49%) of the regional total. Brazil’s arms imports spiked by 77% between 2015–19 and 2020–24. The primary suppliers to South America were France, the U.S., and the UK. Interestingly, Russia did not deliver any major arms to South America during this period.

Asia and Oceania

Despite being the region with the highest volume of arms imports (33% of global imports), Asia and Oceania saw a 21% decrease in arms imports between 2015–19 and 2020–24. Four of the world’s top 10 arms importers in this period were in this region: India, Pakistan, Japan, and Australia. The United States, Russia, and China were the key suppliers. The U.S. supplied 37% of the region’s arms imports. This trend is largely driven by strategic concerns, such as the rising threat from China, prompting countries like Japan and South Korea to bolster their military capabilities.

The PAF JF-17 Thunder boasts a diverse and lethal arsenal, with further enhancements expected in the Block-III variant. (Image Credit: PAF/QQ/via X)

The PAF JF-17 Thunder boasts a diverse and lethal arsenal, with further enhancements expected in the Block-III variant. (Image Credit: PAF/QQ/via X)

Europe

European arms imports more than doubled (a 155% increase) in 2020–24. This surge was led by Ukraine, which became the largest importer not only in Europe but in the world. Other significant importers in Europe included the United Kingdom (2.5% share of global arms imports and Poland (2.4%). In Europe, the U.S. maintained its strong presence by accounting for 64% of arms imports among NATO states, a significant increase from 52% in 2015–19. German and French arms exports also played an important role in meeting Europe’s growing defense needs.

The Middle East

The Middle Eastern region witnessed a 20% drop in arms imports compared with the previous period. However, it remains a critical market with four of the world’s top 10 arms importers, Qatar, Saudi Arabia, Egypt, and Kuwait, located in the region. More than half of the arms imports in the Middle East came from the U.S. (52%), with Italy, France, and Germany also contributing substantially.

Arms transfers amid ongoing conflicts

The Russian invasion of Ukraine has reshaped arms transfers globally. Ukraine’s dramatic increase in arms imports reflects an urgent need to counter military aggression and improve its defensive capabilities. The support provided to Ukraine by multiple countries, primarily through aid, illustrates how geopolitical crises can rapidly alter the dynamics of the global arms trade.

Emergence and shift

For many states, traditional relationships are evolving. India, for example, is reducing its dependency on Russian arms by turning towards Western suppliers. Similarly, countries like Turkey are emerging as significant suppliers in regions such as West Africa. These shifts are likely to have long-term implications for global alliances and regional security architectures.

Compliance and violations

An important point of concern highlighted in the SIPRI report is the issue of compliance with international arms embargoes. For instance, Russian arms imports from North Korea violated a United Nations arms embargo. Such incidents underscore the complexities and challenges in enforcing international arms control agreements.

North Korean soldiers from tankmen's units of the Korean People's Army firing shots from tanks during a military drill. (Image Credit: KCNA)

North Korean soldiers from tankmen's units of the Korean People's Army firing shots from tanks during a military drill. (Image Credit: KCNA)

Future Outlook

Looking ahead, pending deliveries and ongoing negotiations offer some insights into future trends. The data on pending orders, particularly for high-value systems such as combat aircraft and major warships, suggest that the United States will continue to dominate the global arms market beyond 2024. France also appears well-positioned to maintain its export levels, while the outlook for Russia and China remains uncertain, given the current geopolitical tensions and policy shifts.

In brief, while the global volume of arms transfers has remained relatively stable, the underlying dynamics are shifting rapidly. The increases in arms exports by the U.S. and France, the dramatic rise in Ukraine’s imports, and the evolving regional patterns all point to a complex interplay of security needs, geopolitical strategies, and economic interests that will continue to shape international arms transfers in the years to come.

ALSO READ:

REGIONS

ISSUES

World’s Top 10 Tactical and Combat Drones

World’s Top 10 Tactical and Combat Drones China's Ambitions at Sea and Naval Modernization

China's Ambitions at Sea and Naval Modernization Top 10 Military Tech and Robotics Companies in the World

Top 10 Military Tech and Robotics Companies in the World U.S. Integrating Advanced Robotic and Autonomous Weapon Systems into Army Units

U.S. Integrating Advanced Robotic and Autonomous Weapon Systems into Army Units